Documentation >

MAC-PAC Technical Library >

Financial >

Accounts Payable >

Programs >

Vendor Withholding Window - Purpose

Vendor Withholding Window - Purpose

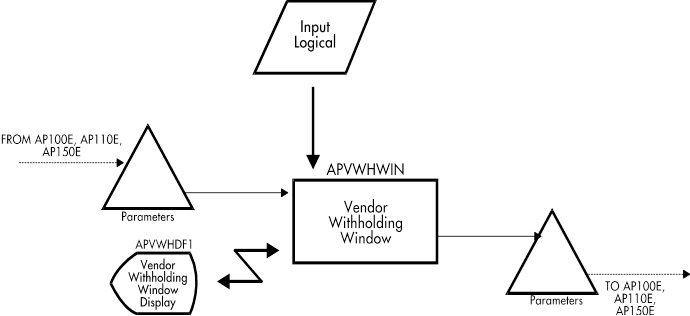

APVWHWIN

The Vendor Withholding Window program (APVWHWIN) displays a pop-up window that allows the user to view and update the withholding information for a vendor. This window is displayed by pressing a command key on the recap screen of the following conversations: Invoice and DR/CR Memo Entry (AP100E), Open Item Maintenance (AP110E), Recording Manual Payment (AP150E). This program is also called to perform the initial withholding calculations without displaying the window when the user enters the recap screen in any of the conversations listed above.

The window displays the current values of the withholding code, withholding rate, amount subject to withholding, and the calculated withholding amount. The withholding code defaults from the Vendor Master file (APMASTP), and the amount subject to withholding is initially calculated based to be equal to the amount subject to tax (either U.S. tax, VAT, GST, or PST).

The user is allowed to override the withholding code and the amount subject to withholding. If either of these fields is overridden, the new withholding rate is retrieved from Reference File category 234 (Withholding Codes) and/or a new withholding amount is calculated.