Documentation >

MAC-PAC Technical Library >

Distribution >

Order Processing >

Programs >

Goods and Services Tax Calculation - Purpose

Goods and Services Tax Calculation - Purpose

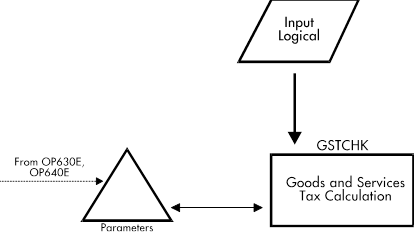

GSTCHK

The Goods and Services Tax Calculation program (GSTCHK) uses the GST/PST calculation routines (GSTCHK, GSTCHK1, GSTCHK2, and GSTCHK3) to calculate the goods and services tax amount associated with each GST code as well as the total GST amount. Arrays are used to carry information related to each GST code, including the GST rate and future rate, the GST effectivity date, the gross sales amount subject to the GST code, and the portion of the gross sales that is subject to a cash discount. The GST rate is multiplied by the total gross sales amount to get the GST amount. This method creates fewer rounding errors than calculating the GST amount at each line and accumulating. In all cases, the calculations are rounded to the decimal precision defined for the currency.

Provincial Sales Tax is calculated after the goods and services tax amount has been calculated. The PST can be compounded over the GST amount. This calculation is performed within the individual programs based on the tax compounded flag (Reference File category 348) and the amount subject to PST.

This program is called from OP630E (Automatic Order Release) and OP640E (Consolidated Billing Update). Externally described data structures are used for passing parameters to this availability checking program.