Documentation >

MAC-PAC Reference Library >

Financials >

Inventory Accounting >

Key Concepts and Procedures >

General Ledger Interface

General Ledger Interface

Inventory Accounting reads transactions from audit trail files, which contain detail about inventory and manufacturing activity. Through the period-end post process, it costs each of the transactions and creates journal entries for posting to the General Ledger. During a trial run, the process generates the entries for reporting purposes but does not update the ledger. This allows you to review the entries and make any corrections before the accounts are updated.

There are two types of post runs - demand and final. Multiple demand posts will be allowed during an accounting period. A cutoff date is required for a demand post. Only transactions up to the cutoff date will be processed during a demand post. If a company/location's accounting period end date is less than the entered cutoff date, then the accounting period end date is used as the cutoff date. The cutoff date used will be displayed on reports so that you can see the cutoff date of IA transactions that were processed by the post run.

For a final post, the accounting period end date is automatically used by the system as the cutoff date. Only one final post is allowed during a period. During the final post run, the current accounting period on Reference File category 023 will be updated.

Trial runs can be either demand or final. If a cutoff date is entered for a trial run, only transactions up to the cutoff date or the company/location's period end date (whichever is less) will be processed. This is considered a trial demand. If a cutoff date is not entered for a trial run, all transactions up to the company/location's period end date will be processed. This is considered a trial final.

The Inventory Accounting journal entries produced during both demand and final post runs will be distributed to the general ledger. The entries are posted based on the account number assignment you define on the Reference File. For more information about how to define these accounts, refer to the Setting Up Account Number Categories key concept.

The period and year posted will be added to the audit trail files. When IA period end processing is run in post mode (either demand or final), the fields will be formatted with the current accounting period and year.

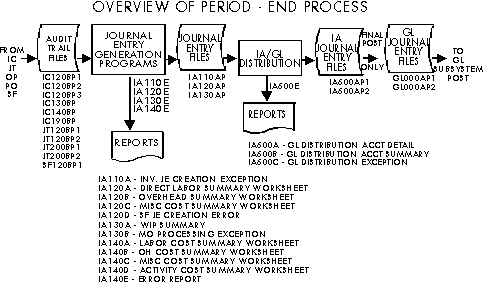

Four Inventory Accounting programs are used to create the journal entries. These programs are called automatically when you request period-end processing. The figure below illustrates which programs, files, and reports are used to create and post the journal entries.

Journal Entry Flowchart

Related