Documentation >

MAC-PAC Reference Library >

Financials >

Inventory Accounting >

Key Concepts and Procedures >

Accounting Standard Costs >

Accounting Cost Generation

Accounting Cost Generation

The objective of standard cost accounting is to value each transaction according to the standard cost that was in effect when the transaction occurred. Consequently, it is necessary to "freeze" the standard costs periodically. Freezing costs takes the standard costs at a particular moment in time and copies them into corresponding fields called "accounting standard costs." The accounting standard costs are used only by Inventory Accounting.

Costs are frozen by running an accounting cost generation within Inventory Accounting. Once standard costs are frozen:

· You can enter standard cost changes for the next period without affecting how transactions from previous periods are valued. The accounting standards are not affected until the next accounting cost generation is run.

· Inventory Accounting will use the frozen costs for all calculations. The period-end posting process values all transactions using the accounting standard costs in place when the post was run. After the post is complete, the transactions can never be revalued at any other cost.

Note: Accounting standard costs are updated only when an accounting cost generation is run. If a standard cost changes during a period, you must run a generation before running the period-end processing for that period.

Also note that only one set of accounting standard costs is used. If a standard cost changes during a period, you must run the period-end processing for the previous period before updating the accounting standard costs. Otherwise, the previous period's transactions will be valued using the new standard.

For first time processing, an Accounting Cost Generation must be requested after all standard costs have been established and before first time period-end processing is requested.

If the General Ledger application is not installed, the inventory accounting journal header file (IA500AP1) and the inventory accounting journal detail file (IA500AP2) must be saved in history files. By not saving these generated files immediately after a post run, all headers and associated detail will be cleared when the next trial or post run is made.

If the run is a Post Run and off-line processing is completed normally and standard costs have changed within the last period, run the Accounting Cost Generation for the next period.

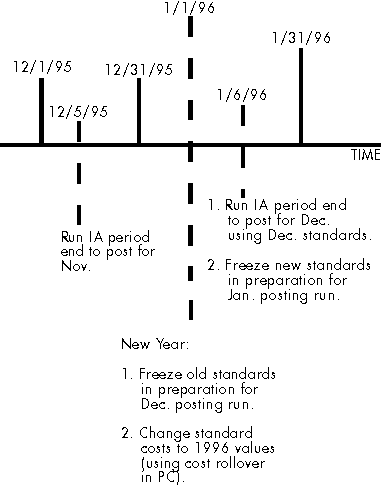

A sample procedure is shown here below:

Sample Accounting Cost Generation Procedure