Documentation >

MAC-PAC Reference Library >

Financials >

Draft Management >

Key Concepts and Procedures >

Draft Management Overview

Draft Management Overview

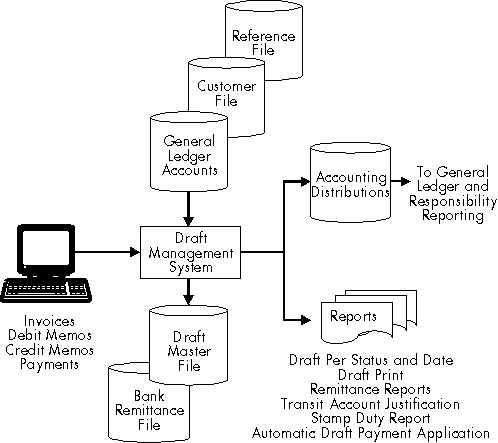

The following figure illustrates the processing performed by the Draft Management module. The Draft Management module provides bank remittance processing for customer payments received through Accounts Receivable. Included in this processing is the handling of drafts received from customers and drafts created through Order Processing, Synchro, Accounts Receivable, and the Draft Management modules. The Draft Management module deals strictly with Accounts Receivable processing. Accounts Payable draft processing, although mentioned in this manual, is handled entirely within the Accounts Payable module. For additional information in Accounts Payable draft processing, see the key concept on Draft Processing in the Accounts Payable User Manual.

Differences Between Drafts and Other Forms of Payments

A draft is a payment document with a specific due date; so a draft is different from a check, which is payable on sight. A draft also has a bank remittance procedure, so it is different from a bank transfer, which is an order directly sent to the bank. Drafts are most often transmitted electronically between vendors, bank, and customers. The electronic data interchange (EDI) transactions may be supplemented by a magnetic tape or paper documents.

Different Types of Draft Payments

There are two different types of procedures for draft payments. The person who issues the draft may be either the vendor or the customer. If the draft is issued by the vendor then it is called a bill of exchange. If the customer issues the draft, then it is called a bill of order. Draft information for bills of exchange created through Order Processing, Synchro, Accounts Receivable, and Draft Management is contained on the Draft Master File. In Accounts Receivable, bills of order are not recognized by the system until payment entry time. Similar to check processing, information is only maintained for them on the Payment Header File (ARPMNTP). For bills of exchange, bills of order, and non-draft payment types with a remittance procedure, additional information concerning remittance processing is maintained on the Bank Remittance File (DMBKRM).

The Accounts Receivable payment types exist on Reference File category 344. They include check, clearing, write-off, bill of exchange, and bill of order. Within Accounts Receivable, a default payment type is stored on the open item header. In Accounts Receivable invoice entry, the default payment type can be directly entered. In Order Processing and Synchro the default payment type is defaulted from the Customer Payment Terms (Reference File category 323). If this default is blank, the payment type then defaults from the Customer Master File (ARCUSTP). If the payment type is a bill of exchange, a draft can be created at the time the customer open item is created. If the customer has not pre-approved the draft, the bill of exchange is sent with the open item for the customer's approval. After it is confirmed that the customer will be using a draft to pay an open item, the payment application process is performed. At this time, the open items Accounts Receivable balance is transferred from Accounts Receivable into Drafts Receivable and the open item is changed to Paid. A draft can be applied to the original open item for which it was created or any other open item for the customer. A batch application program allows you to automatically apply pre-approved bills of exchange to their corresponding open items.

The Accounts Payable module can issue bills of order to vendors or approve bills of exchange that are received from vendors. Payment types are defined on Reference File category 240 and include check, clearing, bill of exchange, bill of order, and quick check (used for manual payments). The default payment type is specified on the open item. At payment creation time, a bill of order will automatically be created to accompany the remittance if necessary. At the same time, the vendor Accounts Payable balance is decreased by the amount of the payment and the Drafts Payable balance is increased by the same amount. Depending on the payment type used, this Drafts Payable balance can be automatically credited to the Cash account on the due date of the draft.

For Accounts Receivable, the Draft Management module provides a remittance creation process for all payments that meet the criteria you specify. The remittance information can be sent to the bank via electronic media or paper. At the time of remittance, the transaction amount is transferred from the appropriate Drafts Receivable/Payments Awaiting Remittance account into either Cash or Drafts in Transit, based on the policies you specify. If the Drafts in Transit account is used, the draft amount will be transferred to Cash on the draft due date. In addition, the software supports accounting transactions for draft risk and unpaid/claimed back draft expenses. For drafts remitted before the due date, the software supports manual transactions for recording the discount.

In the Draft Management module, the Draft Creation, Draft Maintenance, Draft Inquiry, Draft Print, Draft per Status Report, Unpaid/claimed Back Draft Entry, and Consolidated Draft conversations only apply to bills of exchange.

System Overview

Draft Management Processing

Processing Applications

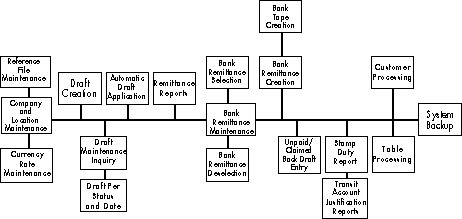

The figure below illustrates the functions and general sequence of system processing within the Draft Management module. Key functions, such a bank remittance processing, draft processing, and customer processing, are discussed on the following pages.

Sequence of System Processing

Key Steps for Using Drafts

The following steps are involved in setting up data for the Draft Management module:

· Define any required Reference File categories:

328 - Document Types Defaults(A/R) - Define the two-character default codes that identify each document type in the system. Additional user-defined default document type codes can also be defined here. This is a required category and is defined for Accounts Receivable.

329 - A/R Document Types (AR) - Defines the valid document codes that identify each document type in the system. Each document type will be defined with a document group which will indicate whether the open item will be processed as an invoice, debit memo, credit memo, cash sale, finance charge, or unpaid/claimed back draft.

344 - Payment Types (A/R) - Defines the valid methods of payment a customer may use to pay the company. Additional user-defined payment type codes can also be defined here. This is a required category and is defined for Accounts Receivable.

For each payment type, you can decide the type of payment processing to be performed. For a draft, you must enter either a '4' or '5' in the Type field. The Pre-accepted Draft field and Magnetic Remittance field must be 'Y' for a bill of exchange. The Bank Remittance Flag must be 'Y' for drafts.

012 - Applications Installed - Enter an applications installed record specifying which applications are installed. Set flag to 'Y' for DM.

133 - System Options - Add a system-wide option for single/multi-currency processing, book code processing, the currency level for the customer, and the address format for the system. In addition, this category determines if Management Accounts, ESL/SSD, or Inventory Cost Analysis are used.

· Add records for the following Draft Management Reference File categories:

Required

F34 - Remittance Number - Assigns the next remittance number in the Bank Remittance Creation processing. This number is automatically updated during such processing.

F37 - Next Available Draft Number - Assigns the next draft number at the time of draft creation.

F40 - Remittance Support - Indicates the type of remittance that will be created; either paper or magnetic.

F41 - Remittance Status - Identify codes and descriptions for the remittance status codes. This category is already pre-installed.

F44 - Draft Status Codes - Contains the status codes valid for a bill of exchange. This category is already pre-installed.

F45 - Remittance Procedure - Define the remittance procedures for all payment types which require bank remittance processing (Bank Remittance Flag set to 'Y' on Reference File category 344). Must be defined for payment types that have the With Bank Remittance flag set to 'Y' on Reference File category 344. This would include bill of exchange and bill of order.

F48 - Remittance Type - Defines the accounting transactions which are to be used at remittance creation time.

F49 - Remittance Bank Entry Type - Defines which payment types are valid for a particular remittance type.

002 - Entity Name - Add on entity name record for the combined entity (key of all blanks). Add an entity name record for each company. Add an entity name record for each company/location combination. If in a multi-currency environment, also specify the base currency code and description for each entity.

Optional

D89 - Decimal Precision -Specifies which categories use zero decimal precision rather than the standard two-decimal precision for currency amounts.

007 - Country Codes - Assign codes and enter country names for each country to be processed.

015 - File Status Codes - Contains IBM codes for error/exceptions encountered on file I/O operations.

017 - Commitment Unit - Defines system operating limits and controls.

019 - System Printers - Assign a printer used to print checks, drafts.

049 - Date Format - Define all date formats to be DDMMYY, MMDDYY, or YYMMDD.

119 - Default Location - Defines default company/location code used for journal entry online conversations for an operator.

135 - Default Book Code - Defines default book code for specified online conversation.

D94 - D99 - These user-defined literals are used for defining user-defined fields in Customer Master Maintenance and Account Master Maintenance, Vendor Master, and Company/Location Maintenance.

F31 - Unpaid/Claimed Back Types - Defines the accounting transactions and replacement document information to be used when processing unpaid/claimed back drafts.

F32 - Bracket Stamp Duty - Defines stamp duty amounts assigned to each bracket number. Required if the payment type requires stamp duty (defined on Reference File category F45). If Stamp Duty flag is 'Y' on Reference File category 344 for the payment type, then every company/location using that payment type must have a stamp duty bracket setup on this category.

F35 - System Statement Codes - Defines the codes used to represent monthly and weekly draft consolidation intervals. Required if draft consolidation is used.

F36 - User Statement Codes - Defines the codes to represent user-defined draft consolidation intervals. Required if draft consolidation is used.

F38 - Next Consolidated Draft - Contains the next available statement number that will be assigned to the Consolidated Draft Statement. Required if draft consolidation is used.

F39 -DM Defaults - Provides the default values for the bank code, currency code, remittance amount, remittance type, remittance support, text lines, text length, and separators for specific company/locations that are initially displayed during data entry. These values can be overridden.

F50 - Bank Account/Number Mask - Includes an edit mask that will be used to validate the bank account and bank number fields in the Draft Creation (DM100E), the Payment Application (AR120E), the Draft Maintenance (DM110E), the Bank Remittance Maintenance (DM120E) and Bank Definition (CF210E) programs.

· Draft information for the customer is also defined in the Customer Master Maintenance conversation on the Draft Information screen (AR630S06). On this screen, you can indicate whether a bill of exchange will be created on a per document basis or for a grouping of documents via the Consolidated Draft Program. For customers not paying on a statement basis, you can indicate whether you want drafts created for debit memos. You can also enter bank information indicating the bank the customer typically uses to process drafts or payments on a remittance procedure.

· Define all drafts to be tracked by the module. Drafts are defined in the Draft Master File (DMDRFP).

· Define all bank remittance information to be tracked by the module. Bank remittance information is defined in the Bank Remittance File (DMBKRM).

· Define all bank information for a company/location to be tracked by the module. Bank information is defined in the Bank Account Master File (CFBAMP).

· Define bank payment type information for a company/location to be tracked by the module. Bank payment type information is defined in the Bank Payment Type File (CFBPTP).

· Set up company/location addresses in Company/Location Maintenance Program (CF280E).

Impact of Draft Management Module on Other Modules

The following MAC-PAC modules support drafts:

The Order Processing, Synchro, and Accounts Receivable modules perform relatively the same processing functions for a draft payment type. In Accounts Receivable invoice entry, the default payment type can be directly entered. If you don't enter a payment type, as in Order Processing and Synchro, the payment type will default from Reference File category 323 (Payment Terms). If a payment type has not been specified on this category, then it will default from the Customer Master File (ARCUSTP).

The Order Processing module generates bills of exchange for invoices and debit memos if certain customer conditions exist and if the Draft Management module is installed. The Synchro module functions the same as Order Processing but for invoices only.

The Accounts Receivable module also accepts bills of exchange and bills of order as valid payment types.

The Accounts Payable module accepts drafts as default payment types for open items. If a bill of exchange or bill of order is entered, draft processing must be allowed on Reference File category 200. The payment types must exist on Reference File category 240 and Draft Management must be installed. At payment creation time, a bill of order will be automatically created to accompany the payment.

The following steps are involved in setting up data for drafts:

1. In the Order Processing, Synchro, and Accounts Receivable modules:

· The flag must be 'Y' for DM in Reference File category 012

· Payment types must exist on Reference File category 344

· Payment type must be a bill of exchange for a draft to be generated

· Customer must not be paying on a statement basis

· Open amount is greater than zero

· Reference File category F37 must be setup with next draft number for the company/location

· Reference File category F45 must be setup with bank remittance information if necessary

· For debit/memos, the flag on the Customer Master Maintenance - Draft Information screen must be 'Y' for 'Statement with Debit Memos'.

2. In the Accounts Payable Module:

· Draft Management must be installed on Reference File category 012 in order for drafts to be generated. Draft processing must also be allowed on Reference File category 200.

· A draft can be generated automatically or manually depending on which conversation you choose.

Draft Processing

Drafts can be created manually or automatically. Drafts created manually are entered through an online data entry transaction. The conversation screen illustrated below is used to enter bills of exchange to pay invoices/debit memos for which drafts were not created automatically. A new draft number is generated and a draft record is created with a submitted to acceptance status.

WILLIAMS DRAFT MANAGEMENT 12/14/92

DSP01 MANUAL DRAFT CREATION

Co/Loc 001 BRU

Customer WEISS

Issue Date 10 08 93

Due Date 11 19 93

Payment Type BE

Draft Amount 100.00 Currency USD

Bank Name

Bank Address

Bank Number

Bank Account

F2=Command F3=Exit F4=Prompt F15=Rekey Data

Manual Draft Creation Screen

|

If a draft was created automatically or manually processed for an open item, it can be updated through the online maintenance data entry conversation illustrated in the following figure. This conversation maintains drafts that are submitted for acceptance by allowing you to update the draft status, refusal date, revised due date, draft amount, and bank information. A draft follow-up report including draft per status, per issue date, per due date, and per payment type can be performed.

WILLIAMS DRAFT MANAGEMENT 12/16/92

DSP01 DRAFT MAINTENANCE DETAIL

Co/Loc 001 BRU Draft Number 00000019

Customer WEISS Draft Status A ACCP

Issue Date 10 26 92 Acceptance Date 11 05 92

Original Due Date 11 30 92 Refusal Date

Revised Due Date Payment Type BE

Draft Amount 47370.66 Currency USD

Document Number IN FAT4 001 Document Date 10/26/92

Bank Name

Bank Address

Bank Number NUMBER15.......

Bank Account ACCOUNT15......

F10=Selection F13=Cancel Trans

Online Maintenance Data Entry Conversation Screen

|

Consolidated statements are printed for customers paying on a statement basis and may be used for bill of exchange payment types. If a customer is paying on a statement basis at invoice/debit memo creation time, a bill of exchange will not be created. Instead, draft consolidation is run. Draft consolidation groups documents together for a particular customer/due date/currency code and creates one draft to cover the entire open amount.

Bank Remittance Processing

Before a draft is sent directly to the bank (like a bank transfer), it must go through a bank remittance procedure. Remittance to banks is performed by the vendor. You decide the bank remittance date and procedures for customer defaults.

From the Remittance Reports Request screen (DM380S01), you can print three different types of remittance reports to view bank remittance information. The types of reports are: bank remitted, selected for remittance, or not selected for remittance. An example of the payments selected for remittance report is illustrated in the next figure.

DATE 11/25/92 ANDERSEN SOFTWARE EUROPE PAGE 2

TIME 11:19:36 ANDERSEN SOFTWARE - BRUSSELS CO 001

REPORT DM590A REMITTANCE REPORT - SELECTED ITEMS LOC BRU

REQUESTOR WILLIAMS

BANK CODE B1 NATIONAL BANK OF DYER

PAYMENT CURRENCY USD US DOLLAR

SEL REMIT REMIT PMT CUSTOMER CUSTOMER

REM TP DUE DATE DATE NUMBER TYP PAYMENT NO PAY DATE NUMBER NAME PAYMENT AMOUNT

------ -------- -------- -------- --- ----------- -------- ----------- ------------------------------ ------------------

1 1/31/91 0/00/00 BE 50000020 1/01/91 E1 STEIN AEG 33.33

TOTAL DUE DATE 1/31/91 33.33

1 2/20/91 0/00/00 BE 50000019 1/01/91 E1 STEIN AEG 50.00

TOTAL DUE DATE 2/20/91 50.00

1 3/31/91 0/00/00 BE 50000021 1/01/91 E1 STEIN AEG 33.33

TOTAL DUE DATE 3/31/91 33.33

1 4/30/91 0/00/00 BE 50000022 1/01/91 E1 STEIN AEG 33.34

TOTAL DUE DATE 4/30/91 33.34

1 11/25/92 0/00/00 BE 50000026 11/25/92 E2 STEIN AEG 110.13

1 11/25/92 0/00/00 BE 50000027 11/25/92 E2 STEIN AEG 110.13

TOTAL DUE DATE 11/25/92 220.26

1 11/30/92 0/00/00 BE 50000003 10/20/92 E1 STEIN AEG 66.67

1 11/30/92 0/00/00 BE 50000006 10/20/92 E5 STEIN AEG 116.67

TOTAL DUE DATE 11/30/92 25,481.67

1 12/20/92 0/00/00 BE 50000018 11/09/92 E1 STEIN AEG 100.00

TOTAL DUE DATE 12/20/92 100.00

1 12/25/92 0/00/00 BE 50000025 11/25/92 E2 STEIN AEG 110.00

TOTAL DUE DATE 12/25/92 110.00

1 12/30/92 0/00/00 BE 50000012 10/26/92 E1 STEIN AEG 100.00

TOTAL DUE DATE 12/30/92 100.00

1 12/31/92 0/00/00 BE 50000001 10/19/92 E1 STEIN AEG 33.33

1 12/31/92 0/00/00 BE 50000004 10/20/92 E1 STEIN AEG 66.67

1 12/31/92 0/00/00 BE 50000007 10/20/92 E5 STEIN AEG 116.67

TOTAL DUE DATE 12/31/92 216.67

1 1/31/93 0/00/00 BE 50000002 10/19/92 E1 STEIN AEG 33.34

1 1/31/93 0/00/00 BE 50000005 10/20/92 E1 STEIN AEG 66.66

1 1/31/93 0/00/00 BE 50000008 10/20/92 E5 STEIN AEG 116.66

TOTAL DUE DATE 1/31/93 216.66

TOTAL REMIT TYPE 1 26,595.26

TOTAL CURRENCY USD : 26,595.26

** END OF REPORT **

|

Sample Remittance Report

At payment entry time, you decide which open item(s) will be covered by what payment type. If the payment type has a remittance procedure, a remittance record is created and the open item is closed at this point as fully paid. The Drafts Receivable/Payments Awaiting Remittance account is debited and the Accounts Receivable account is credited.

Remittance must be performed when the vendor decides that they want to cash the draft, or for non-draft payment types with a remittance procedure to transfer the payment to the cash account. This usually occurs on the due date, but the vendor can cash early to solve cash/flow problems or attempt to collect from customers with potential credit/bankruptcy problems. Remittance records are sent to the bank via paper or magnetic tape. Tapes can only be in the base currency of the company/location; paper can be in any currency. Payments can be selected manually or automatically. Payments can be deselected, however, you must deselect all payments for the company/location and then re-select the payments you wish to remit.

Unpaid/Claimed Back Drafts

Draft management also includes functions for processing unpaid/claimed back bills of exchange. Sometimes a draft may go unpaid because of insufficient customer funds or other problems such as bank rejections due to formatting, etc. A draft may also be claimed back from the bank and returned and not paid. In these cases, a new document with an unpaid/claimed back document type is created to replace drafts that were unpaid/claimed back.

Customer Processing

The Draft Management module maintains standard and historical data for all active customers. All invoice and payment information is kept at the customer level. Complete customer history information is available online or through a range of customer and credit reports prepared by the system.

Draft Management Information

The Draft Management Inquiry conversation allows users to review up-to-date customer draft information. Users can enter a draft number, company/location, or customer number to view a list of drafts or a specific draft on the system. Only bills of exchange can be inquired upon. From the list of drafts, you can view specific information such as bank information, remittance information, draft amount, and due dates. The conversation screen used to view this information is illustrated in the following figure.

WILLIAMS DRAFT MANAGEMENT 3/29/93

DSP01 DRAFT INQUIRY DETAIL

Co/Loc 001 BRU ANDERSEN SOFTWARE - BRUSSELS

Customer WEISS WEISS AEG

Currency USD US DOLLAR

Payment Type BE Draft Number 50000170 Statement Number

Issue Date 3/15/93 Due Date 4/14/93 Revised Due Date 0/00/00

Draft Status S SUBM Refusal Date 0/00/00 Print Date 0/00/00

Draft Amount 150000.00 Acceptance Date 0/00/00

Document Number IN 10000901 000 Document Date 3/15/93

Bank Name Bank Number

Bank Address Bank Account

F2=Command F3=Exit F10=Selection

Draft Inquiry Screen

|

Comprehensive draft information is contained in several draft reports maintained by the Draft Management module. The Draft per Status and Date prints drafts by status and either issue or due date so the user can select drafts for payments depending on what is available. The Transit Account Justification Report informs you about outstanding payments and helps you to determine which payments have not been remitted as of a specific cutoff date as well as payments that were remitted but not yet due. The Drafts Payable Report maintained in the Accounts Payable module allows you to select drafts at a draft cutoff date for a specific company/location, a specific currency code, a specific draft selection or for a specific bank.