Documentation >

MAC-PAC Reference Library >

Distribution >

Order Processing >

Key Concepts and Procedures >

VAT Processing >

Reporting Transactions between Members of the European Community

Reporting Transactions between Members of the European Community

Defining EC Member States

A key to reporting transactions involving EC countries is determining which customers, warehouses, and vendors are located in member states. In order to consider a transaction as an EC transaction that will be printed on reports, the country code from where the goods are shipped should be different from the country code actually receiving the goods; however, both countries should be members of the European community. For each country, Reference File category 007 specifies whether the country is a member of the European Community.

When you enter a sales order, purchase order, or transfer order, MAC-PAC uses the appropriate address information to determine whether the parties involved are located in different countries. If ESL/SSD processing is used, the country code will be required in the Sales Order Maintenance, Sales Order Shipping/Billing, Purchase Order Maintenance, Transfer Order Maintenance, and Transfer Order Shipping conversations. For customer sales orders, the system considers the addresses of the Ship-to country, selling company/warehouse, and the sourcing company/warehouse. For purchase orders, it considers the addresses of the vendor and the receiving warehouse. For transfer orders, it considers the address of the supplying company/warehouse and the receiving company/warehouse.

The table below summarizes the exoneration terms for each of these orders:

|

|

Country Code on Addresses

|

|

|

Sales Order

|

Ship-to = Selling Co/Whs

|

N if Bill-to Customer=Ship-to Customer

|

|

Sales Order

|

Ship-to = Bill-to = Selling Co/Whs

|

N

|

|

Purchase Order

|

Vendor = Receiving Co/Whs

|

N

|

|

Transfer Order

|

Supplying Co/Whs = Receiving Co/Whs

|

N

|

Exoneration Terms for Sales Orders, Purchase Orders, and Transfer Orders

When entering sales orders, there is additional information that must be processed. If the country codes of the selling company/warehouse, the Ship-to customer, and the Bill-to customer are the same and it is an EC country, then VAT must be charged and the customer’s VAT registration number is not required. This sale is considered a domestic sale. In this case, the exonerated VAT code defaulted from the customer must be overridden by a normal VAT code.

If the country code of the Ship-to address is different from the country code of the selling company/warehouse, and both addresses are in the EC, then the Bill-to customer must have a VAT registration number in the ship-to country. If one exists, then the invoice will be exonerated. Otherwise, VAT must be charged if no VAT ID is provided. In the Sales Order Maintenance conversation, the EC VAT Information window can be displayed in order to select the VAT registration number of the Bill-to customer in the Ship-to country.

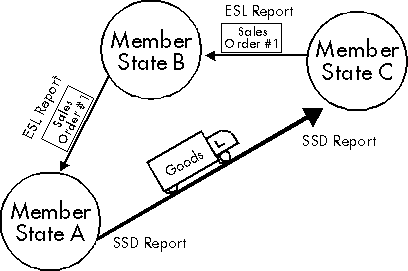

VAT registration simplification can be used in case of triangulation transactions. A triangulation would be when a trader of member state A sells goods to a trader in member state B who in turn sells the goods to a trader established in member state C. The goods, however, are sent directly from member state A to member state C.

Example of a Triangulation

Therefore, since member state B made an intra-community acquisition and an internal supply in member state C, they would be under obligation to register and account for VAT in member state C. This type of processing would force many traders to register for VAT in several member states.

Under simplification arrangements, the obligation to register in member state C can be avoided if the customer in member state C is registered for VAT there and assumes responsibility for the VAT due on the internal supply in member state C.

These simplification arrangements will only apply when all three parties involved are registered for VAT in the EC. In this case, the Bill-to customer is identified in the Ship-to country. If the Bill-to customer is not registered in the Ship-to country, then a ‘simplification directive’ may be used. Since each customer has to be registered in their own country, then the Bill-to customer is not obliged to be registered in the Ship-to country. The customer can simply give his own VAT registration number in his country to his vendor.